Vikings in Greece: Kleptocratic Interest Groups in a Closed, Rent Seeking Economy

Νοέ 13th, 2009 | Μιχάλης Μητσόπουλος, Θόδωρος Πελαγίδης| Κατηγορία: English, Ελλάδα, Επιστήμες, Οικονομικά, Πολιτική | Email This Post

|

Email This Post

|

Print This Post

|

Print This Post

|

Last December, downtown Athens experienced three nights of street battles, arson and looting that became headlines in the international press. We argue that the reasons for this extreme social turbulence are related to the regulatory and institutional rigidities that still prevail in Greece’s economy in spite of the strong growth that it enjoyed till recently and which was as a result of specific factors that can be identified. Furthermore we describe the pattern of state intervention, institutional sclerosis and high administrative costs that secure and allocate rents to interests groups which obstruct all efforts to reduce these rents and to open up the economy.

In particular, we argue that these, numerous, rent seeking groups curtail competition in the product and services markets, increase red tape and administrative burdens and actively seek to establish opacity in all administrative and legal processes in order to form an environment in which they will be able to increase the rents they extract. At the same time, they actively stride to ensure that the rule of law fails to such an extent that the society will not be able to hold them accountable for their actions. We finally argue that certain salient aspects of the design of the Greek political system suggest why Greek politicians are unable to champion reforms and effectively confront the designs of these predatory interest groups.

The design of an effective strategy that may initiate an unravelling of events that can lead to the construction of strong institutions and that will improve the quality of governance in Greece also requires a clear understanding of both the factors that have driven the strong growth of the past years as well as the causes that lead to what can broadly be described as the widespread failing of institutions in Greece today. Both of these, shape the stakes of those that gain from perpetrating the current status quo which forms an environment that obstructs progress and that steadily excludes those who are not well connected with the interest groups from participating in economic and social activities.

The Paradox of Strong Growth with Weak Institutions Explained

The driving force behind the strong growth performance of Greece, around 4% per annum, during the past decade is properly mentioned by the OECD (2007) to be a number of factors among which the ones with the quantitatively most important impact are:

1. The proper liberalization of the credit markets at the beginning of the 1990’s which was completed by the end of the 1990’s at which time it was coupled with entry to the European Monetary Union. Combined these two developments lead simultaneously to macroeconomic stabilization and a steady increase of private credit after 2000.

2. The improvement in the regulation of certain product markets, which has been reduced from a very high level, even though it still remains very high compared to other OECD countries according to Conway and Nicoletti (2006). The OECD database accurately documents the documented improvement mainly to the liberalization of the telecommunications market at the beginning of the 1990’s.

3. The shipping and tourism industry. These secure significant annual revenue inflows that are added to the domestic demand and help to mitigate the huge trade balance deficit.

4. The fiscal stimulus given by the 2004 Olympic Games nourished through public borrowing and that led to the improvement of certain key infrastructure facilities.

5. The inflow of funds from the European Union, within the context of the European Union structural funds and the Common Agricultural Policy, which also contributed largely to the improvement of key productivity enhancing infrastructure facilities. These funds are originating from the contributions the governments of EU member states make to the EU budget and are disbursed by national governments according to rules set by the European Union decision making bodies.

FIGURE 1

Demand Injections in Greece as Percentage of GDP

Source: Bank of Greece, Ministry of Finance and Economy, European Commission Budget and EUROSTAT.

Figure 1 shows the size, as a percentage of GDP, of the inflow from EU funds and the expansion of private credit during the past years. It also shows how the expansion of private credit replaced after the beginning of the 90’s the government deficit spending as the main way to finance the expansion of consumption in Greece. The impact of these developments was important as a percentage of GDP for every year during a prolonged period that spans all the duration of Greece’s strong performance. Therefore, the inclusion of this relevant data is appropriate and necessary in order to obtain the most useful conclusions from an analysis of the macroeconomic developments of the country. It has also to be noted that repeated revisions of the data on the actual size of the General Government budget deficit may mean that ultimately there was no fiscal retraction after the year 2000.

The rapid increase of new investment depicted in figure 2 demonstrates the impact of the surge in investment that was largely encouraged and financed by the EU structural funds. The fact that a significant part of the increase in investment follows from infrastructure projects is not incompatible with the fact the ICT share of the total investment in Greece is one of the lowest in the OECD. As a matter of fact, the rush into EU financed infrastructure investment was matched by an acceleration of private investment mainly in those sectors that enjoyed deregulation, especially in the growth sectors of banking and telecommunications.

FIGURE 2

Investment to GDP Current Prices in Greece and the Euro Zone

Source: Eurostat.

Yet in spite of the impressive 4% average growth performance of the last 15 years, four pieces of information document that Greece’s economy still retains certain severe structural weaknesses:

1. The inflation differential with the euro zone.

2. The persisting and widening large trade balance deficit.

3. The consistent ranking of Greece by all competitiveness surveys like the World Bank Doing Business and Governance Indicators, the World Economic Forum Competitiveness Index and others in a way that is disproportionally low when compared to its per capita GDP and the fact that Greece is a member of the euro zone and the OECD.

4. The low level of foreign direct investment (FDI) that flows to Greece.

Regarding the inflation differential, it has to be noted that is affects equally the traded and non traded goods and services, which excludes the theory of Balassa and Samuelson as a plausible explanation in the case of Greece. Instead, it seems more likely that in the wake of the significant inflows from the EU and the rapid credit expansion the persistence of the weak competitiveness of the economy has led to the emergence of this inflation differential. This combination of high demand growth that is paired with no matching increase in the competitiveness of a still tightly regulated economy that, with few exceptions, remains far distanced from a market economy has also led to thee widening of the deficit of the goods account from around -12% of GDP before the euro zone accession to -17% in recent years. Also, according to figure 3, FDI inward flows for Greece as a percentage of GDP are very low for almost all years something that is in line with the link between the attractiveness of the business environment and FDI described by Hajkova, Nicoletti, Vartia and Yoo (2007).

FIGURE 3

Direct Investment (FDI Inward)

Source:.UNCTAD Globstat FDI Database.

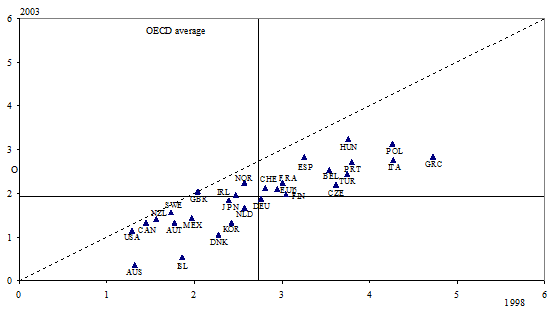

The compelling case for the low competitiveness of the Greek economy is documented by a number of surveys such as the OECD Regulation Database, the World Economic Forum competitiveness survey, the World Bank Doing Business and Governance Indicators. In addition, the European Commission (2006) estimates that in Greece the administrative burden is exceptionally high, around 6.8% of GDP compared with a 3.5% in the EU-25. Patterson et al., (2003) find that the regulation of professional services is high as far as entry and price setting is concerned at the same time that qualitative standards are excessively lax, and the Doing Business ranks Greece to have by far the least attractive regulations regarding the business environment among the euro zone member countries. A good depiction of the regulatory and institutional rigidities in Greece’s economy is provided by the OECD Structural Indicators Database for the year 2003, as unfortunately Greece is one of the few countries that have not provided updates for the year 2007. The methodology used and first described in Conway et al, (1998) reveals the pattern of widespread state intervention in the decisions made by companies regarding resource allocation and pricing, high administrative costs and low regulatory quality. As is shown in figure 4 Greece remained in 2003 among those OECD countries that regulate very heavily product markets and the daily decisions of companies. It has to be added that, not surprisingly, Greece is found by Conway, de Rosa, Nicoletti and Steiner (2006) to be the OECD country which has the most to gain from by increasing competition in product markets in terms of private sector productivity.

FIGURE 4

Product Market Regulation

Degree of Restrictiveness of Regulation Having an Impact on Economic Behavior

Index scale of 0-6 from least to most restrictive.

Source: OECD summary indicator of the stringency of ELP

Kaufmann, Kray, and Mastruzzi (2005) provide evidence that can complement a more general statement, beyond product market regulation and the business environment, regarding weak institutions and poor governance and, finally, Ackerman (2006) suggests how all these facts can be linked with the relatively high levels of corruption that are documented in Greece. The unattractive business environment that is documented by the World Bank and the highly regulated product markets documented by the OECD, and that are linked with the low competitiveness off the Greek economy, emerge therefore as only one part of a more comprehensive pattern of weak institutions and weak governance.

The proliferation of red tape, the excessive regulation of markets, the government interventions that limit competition and resource allocation as well as pricing decisions in crucial network industries all contribute of course to the creation of rents. The case of Greece is unique among the other countries in the sense that it has combined factors that have contributed to the strong economic performance of the past years while maintaining such significant rents. Furthermore, the rapid growth of the past years has made the extraction of rents even more lucrative in this environment of weak institutions and weak governance. As credit growth and EU inflows financed consumption, the predatory behavior of aggressive rent seeking groups has not led to the expected decline of the prosperity of an economy that raises everywhere massive obstacles to any effort to lawfully produce something. This fact may ultimately explain also why the interest groups did not aim to obstruct the reforms that were promoted in the credit markets as well as EMU accession. This pattern can also explain the success of tourism and shipping that contribute to the services account surplus, as they are less affected by the regulatory environment of the Greek economy than other sectors. That is the case either because they operate almost completely outside the Greek jurisdiction and administrative reality, for the case of shipping, or because they draw their competitive strength largely from the geographical attractiveness and the cultural heritage of Greece, as is the case for tourism.

Finally, the momentum of the growth of the economy paired with the necessity to implement EU directives has also led, after many difficulties, to the ability to occasionally override such opposition, as has been the case for the telecommunications market. In the end though, product market rigidities and labor market distortions still complement each other in Greece today, reducing competition along a wide array of economic activities and creating sufficient rents to keep satisfying numerous interest groups.

Having identified in Greece the causes of rapid growth, as well as being able to pinpoint the remaining shortcomings as the result of a low quality of governance that affects, among other, the business environment we can describe Greece as a benchmark case of a country that managed to achieve rapid growth because it took some steps in the right direction, but that still needs to deal with significant challenges regarding the quality of its institutions and the quality of governance if it wants to consolidate the gains of the past and secure long term growth prospects that will enable it to complete the effort and become a member of the club of developed countries. This picture fits well with the example of other countries that manage to initiate growth but not to complete their transition towards the group of developed countries and that are analyzed by Rodrik (2007).

The Political Economy of a Closed Society: Rents, the Design of the Greek Political System and the Blockage of Reforms

We proceed now to demonstrate how the combination of the different aspects that describe the reality of the Greek economy and society complete ultimately the design of a system in which reform minded politicians, that threaten the status quo, are easily removed from the political scene while at the same time those politicians that cooperate with the interest groups are rewarded with long lasting political careers and with immunity from almost any unlawful act they may engage in.

Description of the Players of the Game

Mandate holders, lawmakers, bureaucracy, mandate issuing voters and interest groups that include the media form some of the key players in the reality of Greek politics and the Greek economy. Each of these groups plays a specific role in the power game of Greek politics and economics which results in the defense of the status quo against any reforms. In this context, it is important to show, prove and understand that the anomalies and rigidities regarding various markets in Greece’s economy, such as the labor and the product market institutions or serious and unfair distortions regarding the tax system, have all roots in what is a sum of half closed markets, the political market itself included. We, thus, proceed below to identify and analyze each of these key elements separately:

1. The groups of special interests that defend the status quo and that seek and defend legal or illegal grabs, theft and rents.

2. The role of misinformation of the rationally uninformed voter in a system that shuns transparency.

3. The role of the media as an information broker that can determine a crucial role in directing the dissatisfaction of the voters and that has the capacity to make voters understand the contribution of reforms, but that is itself a victim of blackmail from the constellation of interest groups.

4. The administrative insufficiency of the state as far as the establishment of the rule of law is concerned.

5. The failure of the mandate holding politician as a lawmaker.

Powerful, Kleptocratic Interest Groups as Rent Seeking ‘Vikings’ in Greece

In Greece today there are numerous groups that act like the Vikings, in the sense that they grab anything they can while roaming freely through various aspects of social and economic activity. At the same time the existence of pockets of rent is widespread throughout the economy as a result of government regulations that aim specifically to create such pockets of rent by the obstruction of free competition, but also by the effective reduction of transparency and accountability in the management of public money in a way that allows the proliferation of pork barreling. These pools of rent are claimed by the many small, but well placed and organised, groups that succeed to earn significant rents, and therefore have a strong motive to maintain the status quo and oppose any reforms that will lead to the removal of these pools of rent. These groups draw a significant advantage from the small size each of them has, as they do not contain free riders that could undermine their agenda or fail to contribute actively towards their interests. These groups exhaust most of their available time and power to defend their privileges of a comfortable income that does not require them to work. They promote legislation that will favour them and constantly seek new opportunities that could increase their rents. In this effort, they rationally invest time and money to influence policymakers and the administration.

These groups are not stationary and with a clear position in the system, like lobbying groups, but they are usually formations and alliances of smaller groups that occasionally merge unofficially and ad hoc whenever their interests are aligned in their search for new rents and/or their defence of the existing rents. It is this peculiar attribute that allows them to gain on the one hand the benefits of small size, and the absence of free riders, with the clout that the larger constellations of these groups can muster whenever any reforms must be resisted. They also form immediately loose but strong alliances with other groups whenever any poll of rent is threatened by a reform as they realize that the groups whose rent they defend today will also rush to support them as soon as their pool of rent is threatened by another reform minded politician or a European Union legislation. In this process, these groups fully take advantage of both the lack of checks in the system that would allow the interested general public to object such a raid and, in addition, the meticulously established lack of transparency. The absolute coincidence of the executive and legislative branch in Greek politics is only one attribute that has been installed in order to remove any checks and balances from the system, while the fact that neither the minutes of the committees of the parliament nor all court decisions are published for the public to scrutinize them are only basic examples of how the lack of transparency has been effectively and meticulously established in Greece.

In this setting the acquisition of rents takes any convenient form. It can be legal as long as legislation, that is passed effectively unchecked, creates a legal rent or shuns competition in a market and allocates privileged access to this market to the beneficiary interest group. And it can simply be illegal. But it should be noted that thanks to the, again meticulous, undermining of the rule of law which primarily takes the form of the very slow proceedings of the judiciary, as shown in Mitsopoulos and Pelagidis (2007b), but also, when necessary, blunt interventions in its proceedings, the interest groups deem that the illegal rents are broadly equally attractive with the legal rents. In these cases of illegal activity the rent is obtained through suffocating blackmailing of the lawmakers and the executive and a blunt horse trading with the administration that fits the pattern described by Tullock (2005) and that takes as given the fact that nobody will ever report the breaking of the law or, in the rare case that this happens, no effective punishment or remedy will be enforced.

Rationally Ignorant and Misinformed Voters

The expression of the voice of a voter in a system that favors public debate and the incorporation of different preferences that are voiced by various participants in the debate is shunned by the Greek political system that favors the lack of transparency and accountability of the mandate holders in the executive and legislative branches of government. In the Greek system the maintenance of the status quo is secured as long as mandate holders are hold accountable for their actions only by the strategically placed interest groups that blackmail and unofficially control mandate holders, and not the public. This control is necessary to maintain the status quo as in Greece the mandate holders have unchecked powers to promote any legislative and executive initiative without the existence of any checks as described by Mitsopoulos (2007). This means that in theory it would be very easy to pass any reform, and after passing all the reforms to impose legislation that reintroduces sufficient checks and balances. The only thing that secures that this does not happen is the entanglement of the politicians in a powerful web of special interests that threatens to end his political career as soon as there is any indication that he favors such reforms. As a result these groups do succeed to create rents, and to ensure that the legislation passes laws and practices that allocate these rents to themselves, at the static and dynamic loss of the general public and the outsiders who are not placed in any of these powerful groups. These losers are usually large but unorganized groups like the unemployed, the low wage earners, the consumers, the honest taxpayers, the parents of schoolchildren and last, but not least, entrepreneurs who simply want to do their job well and legally. Since the lack of transparency in one of the necessary preconditions for the transfer of these rents to the benefiting interest groups, there is also an effort to suppress the publication of the problems faced by the general public as a result of these activities. This is especially true for the significant level of income inequality that is a result from these large transfers to so many privileged groups at the same time that the society as a whole does not receive the benefits of a well working state that promotes social coherence.

The voters are generally rationally not well informed according to Kaplan (2007) and especially in Greece they are not able to maximize their welfare when faced with a choice of political propositions that are proposed by the candidates for the executive and legislation, even if they seek to maximize their welfare in any way the political system allows them to do. This follows, among others, because of the complexity and opacity of the horse trading game in Greek politics and the interactions of the citizen with the administration, which raise the cost of being well informed and ultimately leads to a bounded rationality of the voters as a result of the lack of their information which is, rationally, not acquired because of their high cost of doing so. It also follows because casting a simple vote that allocates both legislative and executive power to a mandate holder who essentially governs unchecked till the next elections does not allow them to express their varying preferences regarding the maximization of their welfare in a more complex way. Instead they cast a vote on a broad bundle of propositions that does not offer the ability to express separate opinions on smaller differences between candidates. Given the lack of the possibility to express such differences in opinion, the voters do not engage in a costly, and futile, process to inform themselves.

The Role of the Media as an Obstacle to Reform

In this setting the media which is operating in an opaque and unchecked legal and institutional framework, actively engages in a game of misinformation of the voters. Effectively, they take advantage of the high cost of documenting and publicizing any misinformation and trade their ability to guide the opinion of the uninformed public in exchange for favors they receive from the executive, legislature and administration. Given that this ability to determine the opinion voters form could also be used to inform the public about the necessity and the benefits of effective reforms the participation of the media in the constellation of interest groups that interact with the branches of government emerges as a crucial point in the effort to explain the inability of the Greek society of promote these reforms.

In the hypothetical case of the Coase Theorem, where it would be possible to inform voters costless without any intermediary, the media would not exist. In the real world the media gain significantly value as they are the medium to contact and inform the voter, and this value is negatively related with the level of information the voters have, regardless of the information they receive from the media. According to Tullock (1993) the role of the media is especially critical in the effort of politicians to inform (or misinform) the voter groups that they target, and as a result the level of competition in the market for media is crucial in this case. To the extent that the players in the media market are few, as is the case in dictatorships, this level of competition is largely reduced, even if the modern technology makes it more difficult to establish such media monopolies.

In modern democracies the level of competition in the media is ensured by the existence of groups with different interests, and the low cost of transmitting information. In such a setting the decision of a politician to misinform the voters makes is more likely to backfire, as the voter is better informed and may easier understand the effort to manipulate him. This is especially true if the politician attempts to misinform the voters about privileges he is about to allocate to an interest group, and to the expense of the interest of the general public. On the other hand when the general public is not well informed, and when the media is cooperating with the effort to misinform the public and the voters then the ability of the politicians to yield to the pressures and of the interest groups increases. In the case of modern Greece the design of the political system favors the emergence of uninformed voters, and the systematic removal of accountability and transparency from the activities of the legislature, the executive but also the judiciary, strengthen the ability of the media to an unprecedented extent. As a result it comes as no surprise that the activity of these interest groups on the political establishment has led to the entanglement of the media in a weak and distortive framework that ensures that the media groups are themselves victims of blackmail from the political system, and indirectly the interest groups. The deliberate existence of a vague legal framework for media groups that condemns them to effectively operate illegally together with the dependence, by law, of their revenue on undeclared remunerations as well as declared revenue that is allocated, unchecked and in ways that are not transparent, by the administration forces these groups to rationally decide to cooperate with the interest groups. Therefore they emerge as a critical obstacle to reforms, instead of using their potential to inform the public about the necessity and benefits of reform. Their role is amplified as, given the omnipotence of the merged executive and legislative powers and given the lack of checks and the lack of transparency in the activities of the government and administration, they are the essential tool that will secure the end of the career of any politician who wants to introduce reforms that threaten the various pools of rent that the interest groups benefit from.

The Administration as a Prize for the Interest Groups

The government and the administration are supposed to have the monopoly of setting the rules to form and validate contracts between the agents of the society, which are agreed on between them in a framework of free and competitive markets, according to the traditional neoclassical approach. The state, according to the Chicago school, and public choice, is a medium to maximize the income and interest of the most powerful groups. According to this view, the state and its mechanisms are aligned to serve the interests of each government, and the broad group of private individuals that act within its context in order to maximize their interests. It is possible that the state is simply the sum of individual bureaucrats that maximise their own interests, as demonstrated by Niskanen (1971), who happen to have a strong bargaining position against legislators, and that take advantage on the information advantage they have regarding the implementation of public policies. And according to the institutional economists, like North, and the theory of property rights the operation of the state enhances the security of property rights and as a result economic development through the reduction of transaction costs. According to this approach the state, having the monopoly to set property rights, secures the maximization of the welfare of society as this will lead to the maximization of its own revenues

In Greece all these descriptions can be applied to an administration that was, in theory, established to help the arbitration of differences among individuals, to implement public policies, to rectify market failures when they occur, to reduce the transaction costs of the individuals that form the society and to enhance social coherence. This administration, that has its own interests according to the description of Niskanen (1971), maximizes these within the framework of the existing laws, and often does in the context of the public policies that the government promotes. It is this case of the separation of the interests of the politician and the administrator that allows the administrator to have different interests that he wants to promote. In cases like in Greece where the administration is not Weberian and powerful, but sprawling and at the same time powerful, because of the lack of checks and transparency, as well as weak, because of the inability to implement policies in a setting of contradictory and vague rules that are paired with unorganized and badly trained enforcers, this bureaucracy is easily penetrated by the various interest groups. These groups easily recruit members of the administration to their cause, since the abuse of the public office will generally be lucrative and rather go unpunished. This behavior is rational both for the interest groups and for the bureaucrats, and the opportunities that this behavior offers to the members of the bureaucracy that are recruited by these groups in term of extra legal privileges, undeclared income and other legal or illegal benefits are one of the reasons why public sector employment is so desirable in Greece.

As a result the bureaucracy in Greece has evolved to be closer to the descriptions of Niskanen (1971) and the Chicago school in a way that suits the rent seeking groups that hire the members of the administration to align their interests of both of them, to the detriment of the neoclassical description of the state as a guarantor of the rules of the game and as an establisher of more effective institutions and secure property rights, alike to the description of North (1986).

The Failure of the Mandate Holders

In the context of the Greek political system where the interests of the mandate holders are not aligned with the interests of the voters, as a result of the way this mandate is allocated and as a result of the lack of any checks after the mandate has been issued, the agency problem emerges as very important. The mandate holders operate in an environment of weak institutions which does not incorporate open policy debates and the varying interests and opinions that any society harbors. Furthermore, the fact that they are essentially unchecked in a framework that suppresses transparency further enhances the differentiation of the interests of the misinformed voters with the interests of the mandate holders. Acting rationally in this context they aim for reelection by choosing to cooperate with the interest groups, and the media they control, and by shunning reforms that would benefit society as a whole, but trigger the severe punishment from the interest groups and the media that will aim to end their political careers mustering with great speed an alliance to that purpose. The only defense against such an attack would be strong institutions that would curtail such a punishment, which often is by itself unlawful, and the existence of transparency that would allow the voters to be informed about the true intentions of both the reform minded politician and the resisting interest groups. It is no coincidence that over time Greek political parties have themselves acquired a very undemocratic structure, as in this way the ability to protect politicians that cooperate with the interest groups and to remove summarily those who do not is further enhanced.

As long as any single reform minded politician faces this orchestrated and powerful reaction it will remain unlikely that any politician will choose to take the gamble to implement reforms, in spite of the fact that in Greece the executive and legislature are effectively joined and in spite of the fact that if reform was implemented it is very likely that ultimately the interest groups would accept it as argued in Mitsopoulos and Pelagidis (2007a). Furthermore, in a political system that offers no opportunities to voice disagreements and to incorporate these in the official process that shapes policies Mitsopoulos and Pelagidis (2009) argue that there is little chance that politicians will promote reforms in the context of an open debate that will weight the true interests of society and that will lead to the adoption of laws that are close to the preferences of society, that are easily adhered to and that do not encourage corruption. This reality may indeed be also correlated with the fact that, according to the data published every year by the Ministry of Economy and Finance regarding the income declared by the tax returns filed, the average Greek family does essentially pay no income tax. Indeed, a very small proportion of the population pays the vast majority of personal income taxes forming a much more progressive tax system than in Germany or France for example, as follows from a comparison with the data published by their respective tax authorities. Since the average Greek voter is not paying any income tax and therefore does not consider himself as a tax payer the incentive for politicians to misuse tax funds appears to be increasing to a large extent. In this setting, and from a political perspective, it seems rational to promote the design of a tax structure that puts most of the burden from income tax on a small number of high income earners that declare their income, and then to accept widespread tax evasion especially among the middle incomes which form a large voter pool. This behavior of the policymakers is not driven by their political beliefs, but by rational motives and a desire for political survival in an political environment that does not reward those that serve the public interest. Rationally Greece politicians have retreated to the role as simple intermediaries and brokers between the voters, tax payers and the interest groups and as a result are unable and unwilling to act on altruistic motives and ideology, like the Founding Fathers of the US did. Ultimately this process can only be described as a generalised failure of the mandate holders.

Corruption and the Mistrust towards the Market Economy

Given that the mandate holders do not have neither the will nor the capacity to produce and enforce legislation that is adequate in the context of a global and competitive world market but that they force instead all economic activity to get stuck in a mud of vague, contradictory and often irrational legislation that aims only to create rents it is not surprising that any business initiative in Greece needs excessive time and costs, both legal and illegal, in a context of widespread corruption.

In such an environment of bad legislation, weak governance and high corruption it is not surprising that the process described by Di Tella and MacCulloch (2007) applies, leading the electorate to mistrust a market that is associated with corruption and to support those politicians that champion against marker oriented reforms. In an environment of weak governance demands for increased state intervention in the markets lead to the proliferation of exactly those causes that have lead to the high levels of corruption and the regulatory environment that favours rent seeking and corruption in the first place. Such an environment is indeed compatible with the poor performance of the institutions that should reinforce social coherence as well as with a job market that is increasingly reflecting the closeness of an system that is not competitive enough to create a sufficient number of jobs. In such a system a job becomes a scarce and coveted asset that is becoming itself a prize that the interest groups and the politicians trade for, and that as a result is accessible only to the well connected. The fact that those who are not able to participate in this trading scheme, that is the numerous unconnected young, are therefore facing very unfavourable odds when they enter the job market simply increases the value of the few and prized jobs that this closed system allocates in uncompetitive ways.

The high unemployment of especially the young and the resulting income inequality that is documented by Eurostat are propagated by the media and the populist politicians that have joined these loose alliances with interest groups as failings of the market system. In the end, the failings of the Greek society and economy that are the result of the extensive intervention of a captured state in the product and labour markets in the markets are blamed on the concept of free markets and low administrative burdens. This makes it almost impossible for any politician to associate himself with the notion of free markets and low administrative burden as he is immediately branded to be in favour of income inequality and against social coherence. It is indeed ironic that this happens at the very same time that the rents that are the result of the direct government intervention in product markets form the cornerstone of the process that leads ultimately to the weakening of governance and the undermining of the ability of the state to promote policies that would effectively enhance social coherence and the inclusion of the unprivileged young in the job market.

Conclusions

In this paper we have started out with a brief description of the closeness of Greek economy. We identified both the causes of the recent strong growth performance and the reasons why, in spite of this strong performance, the competitiveness of the Greek economy remains so low. Extensive regulation of markets, high administrative costs, a business environment that is not favorable and, in the end, weak institutions and widespread corruption lead to this low competitiveness. Greece emerges therefore to benefit from certain reforms on a very large scale because of the nature and importance of these positive developments, while it retains other, also significant in importance and magnitude, weaknesses that undermine the long term growth potential of the country. These weaknesses and their proliferation is deeply built in the equilibrium that is formed today between the interest groups that accrue the rents that they secure through the regulation of markets and the inflation of the administrative costs, the politicians and the voters.

The stakes are not only the long term growth prospects of the Greek economy, once the rate impact of the reforms and EU and EMU membership peter out, but also the ability to secure social coherence. The relocation towards a new equilibrium in which rents that are accrued from state intervention and high administrative costs are replaced with profits that accrue from competitive markets, and that are not distributed on the basis of the ability to secure favors from the executive and legislature, but from innovation driven entrepreneurship in competitive markets could secure these stakes for Greece in the future, especially since the magnitude of the stakes at hand exceeds even the stakes that are related with the current state of the public finances in Greece.

The current situation requires for a group of reform minded politicians that will not yield to the pressures of the interest groups and that will have sufficient knowledge to use the significant powers of the government, in spite of the fact that the administration is a weak tool for policy implementation. They will have to first significantly change the rules of the game by setting the legislative framework for free and competitive markets across the board. They will also have to change the constitution, by referendum if necessary, and the rules of the parliament in order to introduce a sufficient separation of the executive and legislature. This needs to happen in a way that will allow both the increase of the ability of society to voice disagreements in the context of the official political process and to ensure that the government will be able to govern “at the end of the day”. This effort must also be complemented with the establishment of sufficient checks and balances and the setting of the legal basis for the widespread establishment of transparency and accountability in all levels of the government and administration.

Michael Mitsopoulos and Theodore Pelagidis

——————————————————————–

Notes:

Δημοσιεύτηκε στι Cato Journal, Vol. 29, No. 3 (Spring/Summer 2009). Αναπαράγεται με την άδεια και του ινστιτούτου και των συγγραφέων.

Theodore Pelagidis is Professor of Economics at the University of Piraeus. Michael Mitsopoulos is Appointed Lecturer at the Economic University of Athens and coordinator of research and analysis at the Hellenic Federation of Enterprises.

References:

Ackerman, S.R., (ed.) (2006) International Handbook on the Economics of Corruption. New Haven: Yale UP.

Arnold, J., Nicoletti, G. and Scarpetta, S. (2008) “Regulation, Allocative Efficiency and Productivity in OECD Countries: Industry and Firm-level Evidence.” OECD Economics Department Working Paper No. 616.

Caplan, B. (2007) The Myth of the Rational Voter. Princeton: Princeton University Press.

Conway, P., Janod, V., and Nicoletti, G. (1998), “Product Market Regulation in OECD Countries: 1998 to 2003.” OECD Economics Department Working Paper No. 419.

Conway, P., de Rosa, D., Nicoletti, G. and Steiner, F. (2006) “Regulation, Competition and Productivity Convergence.” OECD Economics Department Working Paper No. 509.

Conway, P. and Nicoletti, G. (2006) “Product Market Regulation in the Non-manufacturing Sectors of OECD Countries: Measurement and Highlights.” OECD Economics Department Working Paper No. 530.

EC (2006) “Measuring Administrative Costs and Reducing Administrative Burdens in the European Union.” Commission Working Document COM (2006) 691 final (14.11.2006).

Hajkova, D., Nicoletti, G., Vartia, L. and Yoo, K-Y. (2007) “Taxation, Business Environment and FDI Location in OECD Countries.” OECD Economics Department Working Paper No. 501.

Kaufmann, D., Kray, A. and Mastruzzi, M. (2005) Governance Matters IV. Washington DC: The World Bank.

Ministry of Finance (2007) Budget for Year 2007. Athens: The Greek Government.

Mitsopoulos, M. (2007) “Majority Rule, Minority Rights and Corruption.” SSRN Working Paper No. 1018827.

Mitsopoulos, M. and Pelagidis, T. (2007a) “Rent Seeking and ex post Acceptance of Reforms in Higher Education.” The Journal of Economic Policy Reform. 10 (3) (September): 177-92.

(2007b) “Does Staffing Affect the Time to Dispose Cases in Greek Courts.” International Review of Law and Economics. 27 (2) (June): 219-44.

(2009) “A Model of Constitutional Design and Corruption.” presented at the 2009 European Public Choice Society 2009 Athens Conference (2th-5th April).

Niskanen, W. (1971) Bureaucracy and Representative Government. Chicago and New York: Aldine-Athortan.

North, D. (1986) “The New Institutional Economics.” Journal of Institutional and Theoretical Economics. 1 (142). (March): 230-37.

Rodrik, D. (2007) One Economics, Many Recipes: Globalization, Institutions, and Economic Growth. Princeton, NJ: Princeton University Press.

Di Tella, R. and MacCulloch, R. (2007) “Who Doesn’t Capitalism Flow to Poor Countries.” NBER Working Paper No. 13164.

OECD (2006) Going for Growth. Paris: OECD.

(2007) Economic Surveys: Greece. Paris: OECD (May).

Paterson, I., Fink, M. and Ogus, A. (2003) “Economic Impact of Regulation in the Field of Liberal Professions in Different Member States, Regulation of Professional Services.” Final Report-Part3, Study by the Institut fuer Hoere Studien, Wien for the European Commission, DG Competition (January).

Tullock, G. (1993) Rent Seeking. Cheltenham: E. Elgar.

Tullock, G. (2005) Public Goods, Redistribution and Rent Seeking. Cheltenham: E. Elgar.

[…] View original here: e-rooster.gr» English Ελλάδα Επιστήμες Οικονομικά Πολιτική … […]

[…] Read more here: e-rooster.gr» English Ελλάδα Επιστήμες Οικονομικά Πολιτική … […]

@ αρθρογράφους

Το άρθρο σας παρουσιάζει, στην αρχή, τέσσαρα διαγράμματα, εκ των μάλιστα τα (1) και (4) έχουν τρομακτικό ενδιαφέρον αφού επιβεβαιώνουν το πώς λειτουργούσε η αγορά ή οδηγούν σε νέα συμπεράσματα ως προς τους μηχανισμούς της ανάπτυξης.

Στη συνέχεια, ορθότατα, αναγνωρίζετε ότι παρά τον “φαινοτυπικό” αναπτυξιακό οργασμό [ie αύξηση του ΑΕΠ, βελτίωση του βιοτικού επιπέδου κλπ)], κομβικοί μακροοικονομικοί δείκτες όπως έλλειμμα προϋπολογισμού, δημόσιο χρέος, υψηλό και διευρυνόμενο έλλειμμα εμπορικών συναλλαγών, τρομακτικά χαμηλή ανταγωνιστικότης, χαμηλή εισροή κεφαλαίων κλπ παρουσιάζουν με καθαρότητα κρυστάλου ότι η ανάπτυξη αυτή ειναι σαθρή. So far so good!

Στην συνέχεια αναλώνεσθε, σε μιά καθ’ ομάδες-κεφάλαια ανάλυση, που είναι μεν λογική ή θαυμάσια λογικοφανής, χωρίς όμως να την συνδέετε συνειρμικά με συγκεκριμένα ευρήματά σας, as in A leads to B leads to C and so on. Ιnstead, επικαλείσθε τα ευρήματα , θεωρίες κλπ των Χ, Υ, Ζ, αλλά όχι συγκεκριμένα ευρήματα της παρούσης, για να ερμηνεύσετε τη περιρέουσα πραγματικότητα και ειδικότερα την απόκλιση (discord) ανάμεσα σε μιά εντυπωσιακή/ζηλευτή ανάπτυξη από την μια ΚΑΙ την επιπολαιότητα (superficiality), μη διατηρησιμότητα (unsustainability) και σαθρότητά της από την άλλη.

Εάν, λοιπόν, αυτό το άρθρο υπέχει θέση editorial είναι μια χαρά, εάν εγράφη ως research paper παρουσιάζει μεγάλη υστέρηση.

PS Παρουσιάσατε στην αρχή πέντε βασικούς παράγοντες που τροφοδότησαν την ανάπτυξη. Παραλείψατε ένα άλλο σημαντικό, το ΑΘΡΟΙΣΜΑ δηλαδή καλλιεργειών φυτών (Μεσσηνία και Κρήτη) εκ των οποίων παράγονται ναρκωτικά ΣΥΝ το trafficking ΣΥΝ πορνεία/σκυλάδικα Συγγρού και Ιεράς Οδού/Πειραιώς ΣΥΝ “προστασία” ΣΥΝ διεθνείς μαφίες. Κατ’ εικασίες πολλών, αυτός ο θαυμάσια λειτουργών και ΑΝΕΝΟΧΛΗΤΑ τομέας συμμετέχει μέχρι και κατά 20% στην οικονομία της Ελλάδος.

erratum

εκ των μάλιστα τα (1) και (4) -> εκ των οποίων μάλιστα τα (1) και (4)

Και κάτι άλλο. Your talk is replete with riddles and conundrums and innuenda. Why is that?

Καλλιέργειες φυτών (sic) μόνο σε Μεσσηνία και Κρήτη? Ηλεία ? Θεσσαλία ? Θράκη ?

In any case, regardless of how much this paper fulfills each other’s criteria for academic excellence, I hope that George Papandreou will read this. After all, he is the only one that has the power to do anything. Hopefully he has the will to a larger extent that his spineless predecessor.

Let’s not fool ourselves. One way or another, the markets will slowly recover, within a period of a few months or within slightly more than a year, as anticipated. The point is what will become of the Greek economy whose biggest problem is not depicted in the charts but is associated with the suicidal tendencies of the mainland Greece’s residents. Nowhere in the western / civilized / developed world is there a nation obsessed with such a reactionary mentality against anything widely accepted as being an attributable quality of a civilized / western / developed society.

The problem is in the brain and not in the charts.

“Nowhere in the western / civilized / developed world is there a nation obsessed with such a reactionary mentality against anything widely accepted as being an attributable quality of a civilized / western / developed society.”

Ακριβώς!

Το άρθρο αυτό είναι οικονομικής φύσεως.

Δείχνει ΘΑΥΜΑΣΙΑ, λοιπόν, ότι η οικονομία της Ελλάδος ΒΑΣΙΖΕΤΑΙ σε δανεισμό, ο οποίος εν αρχή ΗΤΑΝ αποκλειστικά ΚΡΑΤΙΚΟΣ, με τρομακτική ΑΥΞΗΣΗ του Δημόσιου Χρέους, τώρα με την είσοδο στην ΟΝΕ και τους αναπόφευκτους δημοσιονομικούς περιορισμούς, ο ΔΑΝΕΙΣΜΟΣ μετακόμισε στο ΑΤΟΜΙΚΟ, ή οικογενειακό επίπεδο.

Δέστε στο ΔΙΑΓΡΑΜΜΑ (1) ότι μέχρι Σημίτη, κάπου στη μέση, ο δανεισμός ήταν κρατικός (ο ατομικός ελάχιστος). Επί Σημίτη και εντεύθεν, αφού ΔΙΑΣΤΑΥΡΩΘΗΚΑΝ οι δύο καμπύλες, γύρω στο 1995, άρχισαν να αποκλίνουν ΞΑΝΑ, με μετατόπιση του δανεισμού στο ατομικό επίπεδο.

ΗΓΟΥΝ τοτέστιν δηλαδή

μια οικονομία που βασίζεται σε ΦΡΕΣΚΟ ΑΕΡΑ.

Τα περί αντιδραστικής νοοτροπίας είναι επίσης φρέσκος αήρ. Καλοπέραση θέλουν ΧΩΡΙΣ να εργάζονται. C’ est tout. O Ελληνας είναι ο ΠΡΟΣΑΡΜΟΣΤΙΚΟΤΕΡΟΣ πολίτης του Κόσμου, in fact. Aπλά βολεύεται με την τρέχουσα κατάσταση.

@ gm2263

Δεν γνωρίζω πού ερείδεται η αισιοδοξία σας για τον κ. Παπανδρέου. Ο τελευταίος δείχνει, προς το παρόν τουλάχιστον να δυνατεί να ερμηνεύσει το εκλογικό αποτέλεσμα και, το χειρότερο να αδυνατεί να συλλάβει την μέγεθος της σοβαρότητας της οικονομικής κατάστασης με επικρεμάμενη χρεωκοπία.

1. Αδυναμία ερμηνείας του εκλογικού αποτελέσματος

H NΔ συνετρίβη, συγκεκριμένα έχασε 1.100.000 ψήφους, ενώ παρά την συντριβή του αντιπάλου δέους, το ΠΑΣΟΚ δεν πήρε ούτε ΜΙΑΝ α΄π’ αυτές τις ψήφους, αφού έλαβε ακριβώς 3.000.000 όσες και το 2004, όταν θριάμβευσε η ΝΔ. Δεδομένου, δε, ότι δεν παρατηρήθηκε μαζική στροφή προς κάποιο μικρό Κόμμα, το συμπερασμα είναι ότι οι ΜΗ ψηφίσαντες την ΝΔ, έμειναν σπίτι τους και ΔΕΝ συμφωνούν με τις προεκλογικές υποσχέσεις του ΠΑΣΟΚ διότι αν συμφωνούσαν θα παρατηρούσαμε μετατόπιση ψήφων από ΝΔ προς ΠΑΣΟΚ. Παρότι, διεθνώς, η αποχή ως εκλογική συμπεριφορά δεν φέρει “νομιμοποίηση”, στην Ελλάδα υπάρχει προηγούμενο ΑΠΟΡΡΙΨΗΣ του status quo δι’ αποχής – το 1946 και σε μικρότερα ποσοστά αργότερα. Σε κάθε περίπτωση τα 3.400.000 αθροιστικά της αποχής ΚΑΙ λευκών που προηγείται του αριθμού ψήφων υπέρ της κυβέρνησης φέρει σημαντικό ΜΗΝΥΜΑ.

Εάν ο κ. Παπανδρέου κοι παρακοιμώμενοί του διέθεταν στοιχειώδη αναλυτική ικανότητα, θα μπορούσαν να συμεπράνουν ΟΤΙ εντολή υπάρχει για ΜΟΝΟ ένα πράγμα, ήτοι ΔΡΑΜΑΤΙΚΗ ΠΕΡΙΣΤΟΛΗ εξόδων και δαπανών του Δημόσιου Τομέα και δημοσιονομική εξυγίασνη.

2. Αδυναμία κατανόησης της σοβαρότητας της κρίσης

Ο κ. Παπανδρέου, με την αποφασή του να “χαρατσώσει” ΕΚΤΑΚΤΩΣ μερίδα του Λαού για να ευεργετήσει, πάλιν ΕΚΤΑΚΤΩΣ μιάν άλλη (επίδομα αλληλεγγύης) κάνει ΣΑΦΕΣ ότι αντιλαμβάνεται την παρούσα κρίση ως aftershock της Διεθνούς Κρίσης που χτύπησε την “πόρτα” μας καθυστερημένα, αφού η Ελλάδα ΔΕΝ είναι χώρα που παράγει αγαθά.

Η αλήθεια, ως οι νουνεχείς γνωρίζουν, είναι πως η διεθνής κρίση ΑΠΛΩΣ επιδείνωσε τα ΤΕΡΑΣΤΙΑ διαρθρωτικά προβλήματα της σαθρής οικονομίας μας, παραοικονομίας, in fact, όπου 73% τοτ ΑΕΠ είναι ΙΔΙΩΤΙΚΗ ΚΑΤΑΝΑΛΩΣΗ, όπου το Δημόσιο Χρέος είναι ~ 115% του ΑΕΠ και το Ελλειμμα Τρεχουσών Συναλλαγών (εξαγωγές-εισαγωγές) 170% του ΑΕΠ.

Εάν, από την άλλη, ο κ. Παπανδρέου κατανοεί όλα αυτά άλλά είναι απλά ΟΜΗΡΟΣ των προεκλογικών του υποσχέσεων, ΑΥΤΟΧΑΡΑΚΤΗΡΙΖΕΤΑΙ προδότης της Πατρίδας, όπως ο ελεεινός πατέρας του.

Σε κάθε περίπτωση, ο άνθρωπος πρέπει να σεβασθεί την ΣΟΒΑΡΟΤΗΤΑ και ΤΡΑΓΙΚΟΤΗΤΑ των περιστάσεων Η να παραιτηθεί και να προτείνει τον Θοδωρή Πάγκαλο ως πρωθυπουργό, ή, κατόπιν συμφωνίας με τον μέλλοντα να εκλεγει αρχηγό της ΝΔ, να ζητήσουν απο τον Πρόεδρο της Δημοκρατίας να δώσει εντολή σχηματισμού δικομματικής Κυβέρνησης στον κύριο Σημίτη.

erratum

δυνατεί -> αδυνατεί

H προσωπική μου εντύπωση ενισχύεται από το γεγονός ότι για όλα αυτά τα διοικητικώς νεωτεριστικά που είχε/εχει στο μυαλό του, ωραία ή άσχημα ΗΤΑΝ απροετοίμαστος. Ετσι βλέπουμε ότι 1.5 μήνα + από τις εκλογές΄, παραμένουν απροσδιόριστες ΑΚΟΜΑ και οι αρμοδιότητες των ΕΞ ΑΠΟΡΡΗΤΩΝ υπουργών του!!!!!

ΔΕΝ χωρεί αμφιβολία, λοιπόν, ότι πρόκειται περί ΕΠΙΚΙΝΔΥΝΟΥ για την ΤΥΧΗ του έθνους ατόμου. Είμαι απόλυτα πεπεισμένος – και το λέω καλοπροαίρετα “Κύριε Παπανδρέου, είστε ανίκανος να διαχειρισθείτε την τύχη της πατρίδας”.

και το Ελλειμμα Τρεχουσών Συναλλαγών (εξαγωγές-εισαγωγές) 170% του ΑΕΠ.

Ας μου επιτραπούν ορισμένες διορθώσεις εδώ. Το έλλειμμα του ισοζυγίου τρεχουσών συναλλαγών (ΙΤΣ) στο 9μηνο Ιανουαρίου-Σεπτεμβρίου συρρικνώθηκε στα ΕΥΡΩ 18.3 δις που είναι μονοψήφιο ποσοστό του ΑΕΠ – περίπου 8%. Η συρρίκνωση οφείλεται κύρια στη μείωση του χρόνιου βεβαίως ελλείμματος του εμπορικού ισοζυγίου, που είναι ένα μόνο σκέλος του ΙΤΣ και το πλέον ελαστικό.

Κατά την ταπεινή μου γνώμη, το ανησυχητικότερο πρόβλημα με τη δομή του ΙΤΣ και τη μελλοντική του εξέλιξη έγκειται στις πληρωμές τόκων, μερισμάτων, κτλ. και την αποπληρωμή δημόσιου χρέους προς ξένους “επενδυτές” – κατόχους εντόκων γραμματίων και ομολόγων του ελληνικού δημοσίου.

Tα στοιχεία που παρέθεσα ΔΕΝ είναι από την κοιλιά μου. Μόλις τα ανεκοίνωσε η Διεύθυνση Μελετών της EuroBank με επικεφαλής τον φίλτατο καθηγητή κύριον κ. Χαρδούβελη.

Η ΞΕΝΗ ιδιωτική επένδυση είναι ΠΟΛΥ ΜΙΚΡΗ (και θα συρρικνωθεί) στην Ελλάδα και τούτο απορρέει από το Διάγραμμα # 3 του παραπάνω άρθρου, explicitly and implicitly!

Το τρέχον έλλειμμα, ευτυχώς βελτιώθηκε κάπως, διότι λόγω της κρίσης υποχώρησαν μεν οι εξαγωγές, ΑΛΛΑ ΛΙΓΟΤΕΡΟ από όσο οι εισαγωγές (δλδ τα μπιχλιμπίδια* ΣΥΝ το (υποχωρήσαν) τουριστικό έσοδο ΣΥΝ το ναυτιλιακό (collapsed λόγω μείωσης ναύλων ξηρού φορτίου – οι μεγαλοεφοπλιστές συγκάτοικοί μου δεν έχουν να πληρώσουν κοινόχρηστα!) εισόδημα.

Το ΤΕΡΑΣΤΙΟ, όμως, αθροιστικώς, έλλειμμα τρεχουσών συναλλαγών οφείλεται στο ότι η Ελλάδα, εκτός από ΔΙΑΔΗΛΩΣΕΙΣ και ΣΥΛΛΑΛΗΤΗΡΙΑ κατά πάντων και πασών, ΟΥΔΕΝ ΠΑΡΑΓΕΙ.

Επί πλέον, έχουμε και ένα μεγάλο θέμα (που έθιξε ο laskos αλλού ρωτώντας με αν είναι πρόκληση ή όχι να αγοράζουμε rolex χρυσό).

Το λοιπόν, στην Lllllllllarsha, Ελληνικά μπορεί να μη γνωρίζουν, αλλά ΟΛΟΙ οι νεαροί που “σέβονται” τον εαυτό τους φορούν κολώνια Ted Lapidus (Tεντ Λαπιντού χαχαχαχαχαχα), στην δε Καλαμπάκα, όπου επίσημη γλώσσα είναι το Βλάχικο ιδίωμα, κάθε νέος που θέλει να βγει έξω με κορίτσι της προκοπής και όχι την Ταϋγέτη, αγοράζει με την ντουζίνα εσώρρουχα Calvin Klein – δηλαδή ΟΧΙ μόνο ΔΕΝ παράγουμε, ΑΛΛΑ, παρότι πρωην sans souliers et sans culotte (or should I say εξ αιτίας αυτού) έχουμε και ΚΟΙΝΩΝΙΚΗ ΜΕΓΑΛΟΜΑΝΙΑ. (social aspirations ……. ΠΟΙΟΙ;;;;;; oι ξυπολιαραίοι).

Το τρέχον έλλειμμα, ευτυχώς βελτιώθηκε κάπως, διότι λόγω της κρίσης υποχώρησαν μεν οι εξαγωγές, ΑΛΛΑ ΛΙΓΟΤΕΡΟ από όσο οι εισαγωγές (δλδ τα μπιχλιμπίδια* ΣΥΝ το (υποχωρήσαν) τουριστικό έσοδο ΣΥΝ το ναυτιλιακό (collapsed λόγω μείωσης ναύλων ξηρού φορτίου – οι μεγαλοεφοπλιστές συγκάτοικοί μου δεν έχουν να πληρώσουν κοινόχρηστα!) εισόδημα.

Συγγνώμη για την ΛΑΝΘΑΣΜΕΝΗ μου διατύπωση. Το ΤΟΥΡΙΣΤΙΚΟ και ΝΑΥΤΙΛΙΑΚΟ συνάλλαγμα είναι ΑΜΦΟΤΕΡΑ κομμάτι των εξαγωγών μας in a fiscal sense. Aρα, η σωστή διατύπωση είναι:

Το τρέχον έλλειμμα, ευτυχώς βελτιώθηκε κάπως, διότι λόγω της κρίσης υποχώρησαν μεν οι εξαγωγές ΣΥΝ το (υποχωρήσαν) τουριστικό έσοδο ΣΥΝ το ναυτιλιακό (collapsed λόγω μείωσης ναύλων ξηρού φορτίου – οι μεγαλοεφοπλιστές συγκάτοικοί μου δεν έχουν να πληρώσουν κοινόχρηστα!) εισόδημα ΑΛΛΑ ΛΙΓΟΤΕΡΟ από όσο οι εισαγωγές (δλδ τα μπιχλιμπίδια*).

ΟΚ, αλλά επειδή το πρόβλημα (με τα δημοσιονομικά μεγέθη της Ελλάδος, εννοώ) είναι αρκετά σοβαρό και πιθανότατα θα προδιαγράψει το εγγύς μέλλον της, ας είμαστε, λέω, λίγο πιο προσεκτικοί στη διατύπωση αριθμών και στοιχείων..

Eίμαστε. Εάν έχετε ΑΛΛΑ στοιχεία, διαφορετικά, that is, να τα παρουσιάσετε.

Αυτά που είπατε περί “εξαγωγής” χρήματος λόγω πληρωμής τόκων σε ξένους επενδυτές ΔΕΝ γνωρίζω σε ποιό βαθμό (ποσοστό) συμμετέχουν.

ΑΛΛΑ σε αυτό το πεδίο ΣΥΜΜΕΤΕΧΟΥΝ ΚΑΙ τα ΕΥΡΩ που οι ΑΛΒΑΝΟΙ στέλνουν ΠΙΣΩ στις οικογένειές τους. Το σοβαρότατο, δε, αυτό θέμα [που συνδέεται με το γεγονός ότι ΑΝΟΗΤΩΣ αρνούμαστε να ενσωματώσουμε de jure τουλάχιστον τους παραγωγικούς μετανάστες] το έθιξε αλλού και ορθότατα ο κ. Μπαζιωτόπουλος. Οι μέχρι πρόσφατα δραματικές αυξήσεις του Αλβανικού ΑΕΠ ήσαν ΑΜΕΣΑ συνδεδεμένες με εξ Ελλάδος εμβάσματα.

Επίσης, στην ίδια σφαίρα κινείται και το εξερχόμενο χρήμα για την οικονομική στήριξη (περίπου 0.75-1.0 ΔΙΣ ετησίως) των τέκνων μεγαλομανών χωρικών των οποίων τα ηλίθια παιδιά σπουδάζουν Ιατρική στην Ρουμανία, Διοίκηση Επιχειρήσεων στο Bradford κ.ο.κ. Νομίζω ότι τουλάχιστον τα μισά από τα ελλειμματικά χωριατόπαιδα που πάνε έξω το πράττουν επειδή τα ΤΕΙ μας δεν λέγονται πανεπιστήμια, όπως συνέβη με τα polytechnics της Αγγλίας. Καλο, λοιπόν, είναι να ονομάσει ΚΑΙ η Ελλάδα τα ΤΕΙ τεχνολογικά πανεπιστήμια για να τελειώνουμε ΚΑΙ με αυτή την anomaly.

Όπως και να το κάνουμε το έλλειμμα του ΙΤΣ ΔΕΝ είναι 170% του ΑΕΠ και το ΙΤΣ δεν είναι ταυτόσημα με το Εμπορικό Ισοζύγιο (ΕΙ). Να δεχτώ ότι αυτά γράφηκαν όπως γράφηκαν εκ παραδρομής. Στοιχεία και αριθμοί να φάνε και οι κότες…

Αυτό που ήθελα να πώ παραπάνω είναι ότι το ΕΙ, όπως και το Ισοζύγιο Υπηρεσιών, είναι σχετικά ελαστικά σκέλη του ΙΤΣ. Με το διογκούμενο χρέος και την αποπληρωμή τοκοχρεωλυσίων για την εξυπηρέτηση του εξωτερικού χρέους, το αντίστοιχο, μη ελαστικό, μέρος του ΙΤΣ μπορεί να αναχθεί σε καθοριστικό.

Συντάσσομαι με την τελευταία διατύπωση.

Ως προς τα ποσοστά συμμετοχής του εμπορικού ισοζυγίου ΚΑΙ συγκεκριμένα των ΕΙΣΑΓΩΓΩΝ σε μπιχλιμπίδια στην ΔΙΑΜΟΡΦΩΣΗ του τρομακτικού ελλείμματος Τρεχουσών Συναλλαγών, το ασφαλές του λόγου μου το επιρρωνύει το ΓΕΓΟΝΟΣ ότι το έλλειμμα του ΙΣΤ υποχώρησε ΣΗΜΑΝΤΙΚΑ μόλις υποχώρησε η ΚΑΤΑΝΑΛΩΣΗ κολώνιας “Τεντ Λαπιντού” και μάλιστα, ΠΑΡΑ την μείωση των εξαγωγών προϊόντων μας, και μάλιστα ΠΑΡΑ την κατά >> 13% μείωση του εκ της αλλοδαπής τουριστικού εισοδήματος και μάλιστα ΠΑΡΑ την δραματική μείωση του ναυτιλιακού εισοδήματος.

Οπως λέμε ΚΑΙ στα μαθηματικά, ΟΠΕΡ ΕΔΕΙ ΔΕΙΞΑΙ. Σωστά;

Αυτή δε η κρίση μας παρουσιάζει εάν εκπληκτικό economic model για να μελετήσουμε την δυναμική οικονομιών που βασίζονται κατά >> 70% επί του ΑΕΠ σε ΚΑΤΑΝΑΛΩΣΗ, ΑΛΛΑ και να μελετήσουμε ΤΙ ή ΠΩΣ ορίζεται σε κάθε χώρα σχετική και απόλυτη φτώχεια.

Είδαμε, λοιπόν, πρώτον, την μείωση του ελλείμματος του ΙΣΤ παρά και “εις πείσμα” των υψηλών ανελαστικών υποχρεώσεων εκ τοκοχρεωλυσίων έναντι εξωτερικού δανεισμού κλπ, όπως ορθά λέγει ο rebel.

Δεύτερον, είδαμε ότι οι Ελληνες ορίζουν ως ΣΧΕTΙΚΗ ΦΤΩΧΕΙΑ την αδυναμία αγοράς Prada, Ted Lapidus και Calvin Klein KAI ως ΑΠΟΛΥΤΗ ΦΤΩΧΕΙΑ το να ανγκάζεσαι να πάρεις ΚΤΕΛ (αντί ΙΧ) για να πας στο χωριό σου, ενόσω πριν 40 χρόνια δεν είχες μήτε ημίονο και, επίσης, στο χωριό σου δεν οδηγούσε ούτε καρόδρομος.

ΣΑΝΙΔΑ βρεγμένη ΠΟΙΟΣ θα μου φέρει;;;;;;;;;;;;;;;;;;;;;;

erratum

εάν -> ένα

erratum στο σχόλιό μου #10, ΑΝΤΙ Ελλείμματος Τρεχουσών Συναλλαγών ή ορθή διατύπωση είναι Αθροιστικό Εξωτερικό Χρέος.

πρέπει να διαβάσετε ελληνική ιστορία από 200 έτη αμερικάνικων εφημερίδων<